Designing a Retirement Income Plan

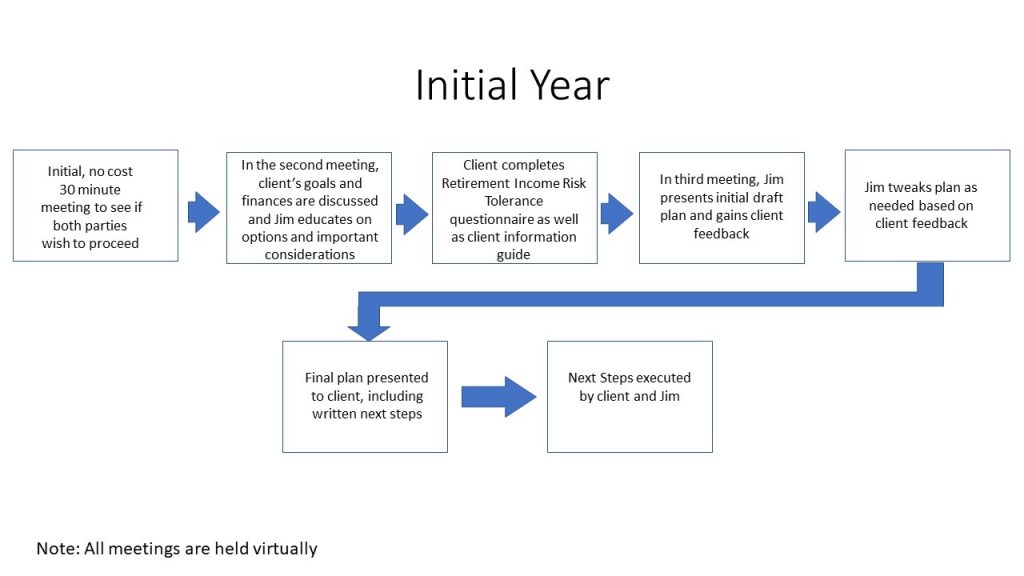

It’s important for prospective clients to understand the process Jim will use to see if it works for them. It’s built on these elements:

- The process of designing a retirement income plan starts with a focus on spending.

- Every retiree has different goals and a risk tolerance for their projected retirement income.

- Each client must invest time initially to arrive at household spending goals, legacy goals, and a retirement income risk tolerance.

- Research Jim and others have published shows that marginal tax rates and Medicare surcharges can often be reduced through taking the proper planning steps.

- Optimizing Social Security claiming decisions is key to protecting a retiree from outliving income, protecting against inflation risk, and lowering taxes.

- Investing in low-cost index funds with proper asset allocation and ongoing rebalancing is important.

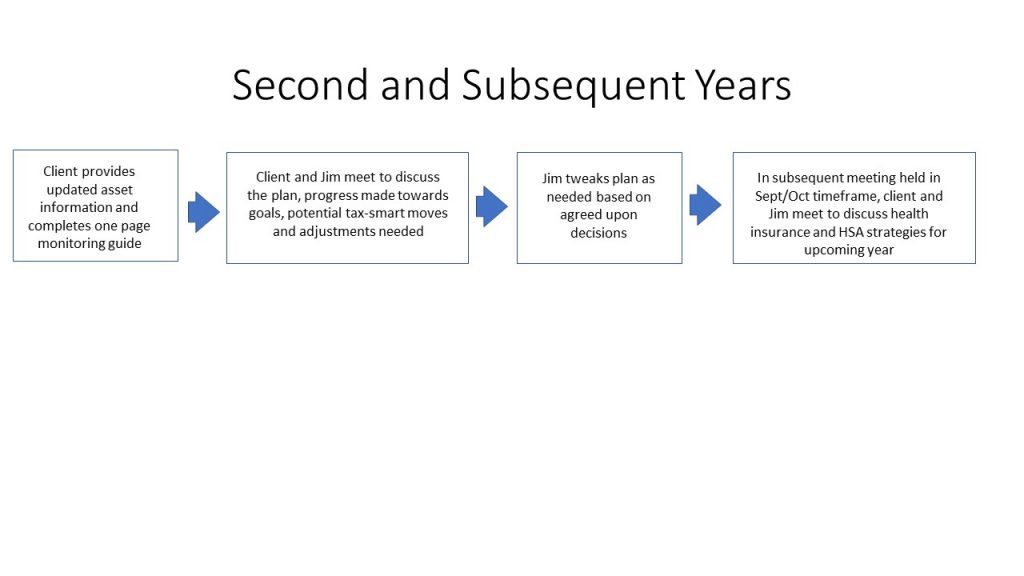

- Ongoing annual monitoring to adjust income amounts and make tax-smart decisions such as whether to make a Roth IRA conversion can enhance a retirement income plan.

- The initial retirement income plan serves as a guide that should be monitored and adjusted in subsequent years as the client’s situation evolves.

Preretirement Check-Up

Upon receiving your personal information and retirement objectives, Jim will assess your circumstances and suggest actionable steps to enhance your retirement readiness. Each check-up is a singular event tailored to the client’s unique needs and preferences, ensuring a personalized approach to updating their retirement preparations.